Difference Between Gambling And Stock Trading

Gambling has been around for more than 2000 years while the first official stuck trading started about 247 years ago in 1773. However, the New York Stock Exchange, which is now the most popular stock exchange in the world, started in 1792. Gambling involves taking risks just like stock trading. This is why many people believe that stock trading is a type of gambling and they aren’t entirely wrong. The thing is that they aren’t entirely right either. Stock trading might have a lot of similarities with regular casino gambling but it is much more complex.

What is the Difference Between Stock Trading and Gambling

Gambling is a zero sum game whereas stock trading is not. Hence stock trading is not gambling In zero sum game, total payoff is zero. In other words, my loss is your gain. There are several key differences. Stock trading is not a zero-sum game. The money that went to the sale of stock was used in the investment of the company, which adds value to the stock. It is possible for both the buyer and seller of a stock to 'win' therefore. Poker is a zero-sum game, and in order for one player to win, another must lose.

With casino gambling, you’ll be placing bets on games and your chances of winning or losing will depend more on luck than strategy. With stock trading, you will be placing bets on company stocks and shares. Stock trading can serve as a long term investment that is much more stable than gambling.

If you buy stocks from the right company, you can become a billionaire who never needs to work again. Let’s use Apple for example. When Apple went public in 1980, they sold their stocks at $22.00 in the initial public offering. At the time of writing, each stock was worth $119.14. If you were among the initial investors who put in thousands of dollars into the company, you would have made millions by now thanks to the success the company has made over the years.

Gambling isn’t something you can use as a primary source of income. It is something you do for fun. The money you make, if you win, is just a bonus. With stock trading, you’re placing bets on the future success of companies. When your shares appreciate, you can sell them and cash out the profit. The right equities can last for a lifetime.

There are stock options that allow you to invest a certain amount and take only the profits on a monthly, Bi-yearly, or yearly basis. It all depends on what you choose. If there is no expectation of returns, you can’t say you’re investing. That’s just charity. With gambling, you’re doing it for the adrenaline rush that comes with gambling but you hope that you can gain some money as well.

Long-term, you’re more likely to lose money gambling than you are to lose stock trading. This is especially so if you trade stocks through a reliable broker. In both stock trading and casino gambling, the higher risk usually means higher returns. The best strategy with stock trading is diversifying your portfolio. Since you’ll be executing different trades, you can minimize risks by investing no more than 5% of your capital in each trade. The risk and return expectation varies greatly across stock options. This is why investors spread their investments across different assets but within the same asset class.

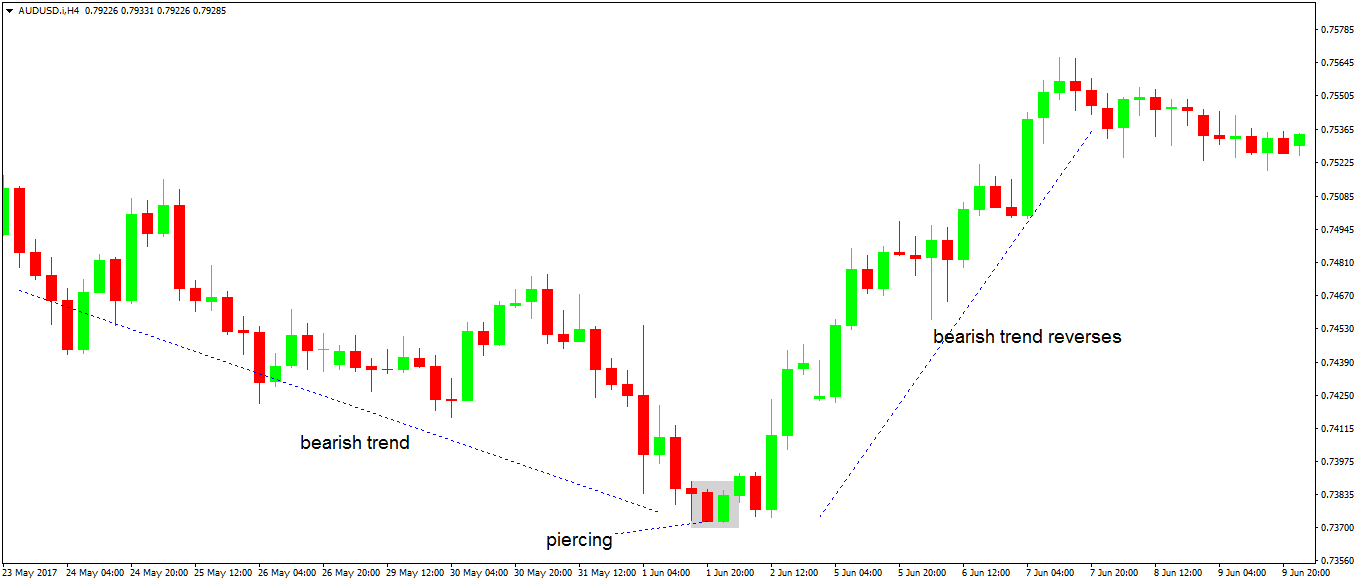

The stock market is not as unpredictable as a casino game. If you learn how to read and understand technical charts, you can predict what direction certain assets will go in the short and long run.

When you’re stock trading through a broker, you will have to pay a certain percentage to the broker as commission. With casino gambling, the only money you’re required to pay is the one you’re wagering. With online sports betting, however, a small percentage of your money goes to the broker whether you win or lose.

Risk management might be one of the hallmarks of stock trading but some professional gamblers know how to establish risk management strategies effectively. These people don’t just see gambling as a fun way to spend their time, they consider it one of their primary sources of income. With time and consistency, a casino gambler can learn to shift the odds in their favor when playing certain skill-based games.

Similarities Between Stock Trading and Gambling

- Both investors and traders deal with odds

- Both investors and traders take risks with their capital

- Both stock investors and traders hope for a return on their capital

- Both gambling and stock trading can be extremely unpredictable

Differences Between Stock Trading and Gambling

- In gambling, winning a bet will cost the casino money but in stock trading, everybody wins

- Stock traders have more ways to mitigate losses than gamblers

- Stock trading becomes favorable to the investor in the long run but gamblers almost always lose more long-term

- Gambling is time-bound but shares in a company can last for as long as the company exists

- Stock traders usually have more information to analyze at their disposal compared to gamblers

How to Get Started With Stock Trading

Step One: Consider Your Options

Stock trading, like every other form of investment, is not meant for everyone. Before you divert all your savings to trading stocks, you need to find out if it is the best strategy for you. Stock trading is primarily meant for people who have maxed out their 401(k) matching at work. If this is the case with you, you should consider purchasing index or mutual funds with any extra money you have left. Note that this isn’t the same as trading individual stocks from a broker. As stated above, stock trading is a risky investment option. So, you shouldn’t dive into stocks until you have saved up a significant amount of money for retirement. You might end up bankrupt if you spend all your savings on the stock exchange.

Step Two: Learn Everything you Can About the Stock Market

Information is everything when it comes to investing. You can’t just pour money into an investment when you don’t have enough information about how it works. The good news is that you don’t need a college education to become a stock trader. Thousands of online resources will help you learn everything you need to know about trading stocks. Some of these resources are free and some are paid.

You can start with the free ones and work your way up as you become more advanced. Websites like Udemy and TD Ameritrade have full online courses for beginners. TD Ameritrade and many other brokers also offer trading simulations that allow you to trade with paper money. Everything about the stimulation is the same as the actual trading. The only difference is that you will not spend real money.

Step Three: Select an Online Broker

When you’ve got a clear understanding of how stock trading offers a favorable environment for beginners and start trading. You mustn’t go for an advanced exchange if you’re a beginner. You might end up losing your money before you even start trading. The best brokers for beginners offer 24/7 customer support, educational resources, trade limits, and account limits as well. These limits help players minimize losses. Some of the best brokers for beg are Robinhood, TD Ameritrade, Charles Schwab, and E*TRADE. There are also many online trading communities where you can ask questions and share insights about trading.

Step Four: Set a Budget and Start Researching Stocks

In the stock trading world, the money you devote to trading, and the more you earn is placed in your virtual portfolio. Since the stock market is as addictive as gambling, you will need a lot of self-control to create a portfolio budget and maintain it. Don’t just start investing blindly. Research the nest stocks in the market and follow the technical indicators and tips on the brokerage of your choice. If you’re interested in individual stocks, read as much as you can about the company. Learn all you can about how their stocks have traded in the past and read productions for the future. Most importantly, read their risk ratings.

Step Five: Start Trading

No matter how much info you have about a company, you can’t give a 100% accurate prediction for the stock. The only way to know exactly how a stock will trade is if you get insider information. Insider trading is a crime and you might go to jail if the SEC finds out what you’re up to. So, instead of waiting for Insider information stick to making smaller trades across assets. Don’t put all your eggs in one basket. Take things slow and steady and only spend money that you can lose without regrets. You should also set a stop loss for yourself. When a particular stock falls below this level, you should sell and cut your losses. There is no need to wait until all your capital is gone.

Bottomline

Stock trading is a more logical investment option compared to gambling. With the right strategies, you can generate millions in profit from trading stocks. Gambling is a recreational activity and it should always be treated as such. Whether you’re gambling or stock trading, you should never let your emotions influence your choices. The last thing you want to do is place a huge bet emotionally and lose all your capital in the process.

Is the stock market gambling? Should people consider trading in the stock market to be a form of gambling? The answers to these questions are an unequivocal – No! Investing in the stock market is not gambling, and novice investors should not think of it in that way.

Online Gambling Stocks

Equating the stock market to gambling is a myth that people on the internet and television pundits have perpetuated for years. And, it’s simply not true.

While investing and gambling have a few similar characteristics, they are very much different. And, if an investor does not take trading stocks or buying shares of mutual funds seriously and equates it to gambling, they are in serious jeopardy of losing money or missing out on gains from the stock market that they need for retirement.

Why Stock Trading Is Not Gambling

Stock Is Ownership

Investors must remember that they are purchasing ownership in a company when they buy shares of common stock. Investors own a very small portion of the company. That’s why I love buying cans of Dr. Pepper. It feels like more money is ultimately going back into my pocket with every sip.

Buying shares of a company is equivalent to having a claim on the assets, debts, and more importantly a small fraction of the profits of the company whose shares you buy. Far too often, investors look at buying shares of a company simply as trading stocks. They forget that they are now owners of the company too.

To gain an advantage and earn a profit on your stock trading, investors must try to gauge the company and its profitability. Incorrectly gauging profitability in the short and, more importantly, over the long term is why stock prices fluctuate on the stock exchanges.

The profit outlook for business is always changing, and investors are using stock charts, news, rumors, company metrics, and fundamental analysis to estimate the future earnings of a company and subsequently the value of its stock in the future.

The Value of a Company

Trying to determine the value of a company’s stock price and where it’s going in the future isn’t easy. There are a lot of different variables that move the short-term price of a company’s stock. They often appear to be random, but they’re not really.

Over the long term, a company’s stock is the present value of all profits that the company will make. In the short term, a company’s share price is a lot more volatile. A company can trade shares even without profits because investors think that the company will have future earnings. But, eventually, a company’s stock price will show the true value of the company.

Similarities in Investing and Gambling Strategies

Studying Behavior

Investors and gamblers study odds and look for an edge to enhance their performance. With gambling, especially games like blackjack and poker, players study behavior. They look at the mannerisms and patterns of their opponents. This helps them gain useful information to influence their betting and strategy.

Investors study trading patterns through stock charts to predict a stock’s price the in the future. Investors have a distinct advantage with gaining information. Company information is readily available on the internet and through company filings with the Security and Exchange Commission (SEC). Investors can find a wealth of information in the SEC’s Edgar database on company stock filings.

Difference Between Sports Betting And Stock Trading

In the Edgar database and company filings, you can find out the types of assets that companies hold and if they are a holding company that other firms underneath its umbrella. For example, 888casino.com is a well-known online casino brand of 888holdingsplc.com. It has many other brands such as 888.com, 777.com, 888poker.com, 888sport.com etc. And, 888holdings Plc actually has shares of stock that trade on the London stock exchange. (symbol 888). So, imagine you invest in the 888holdings share and also play online at their 888casino, that will make you an investor and a gambler at the same time.

Risk

Both investing and gambling involve risk. You have to risk capital in order to gain value in both the stock market and a casino. It is the risk that investors and gamblers take on that gives them the right to earn more than they wagered.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)

Both investors and gamblers must know how much risk they can tolerate, though. Every investor and gambler has a certain risk tolerance that they are willing to lose. You must know your risk tolerance before you start investing or gambling. Not knowing when to stop or sell will make you vulnerable to potentially losing more than you intended.

Differences in Investing Strategies and Gambling

Zero Sum Game

Unlike investing where there are moderate winners and even some losers over the long and short term, gambling is a zero-sum game. There has to be a winner and a loser with gambling. Gambling takes money from a loser and gives the same money over to a winner every time.

In investing, there can be varying degrees of winners and losers. There can be total losers or total winners, but because investors buy and sell instead of waiting for a gambling hand to be completely over, they can have partial winners and partial losers.

But, with gambling, no value is ever created. The value or money wagered is simply transferred from one gambler to another. Investing increases the overall wealth of the economy. With investing, companies increase their productivity and develop new products that improve people’s lives. Companies create profits and share those profits through dividends to investors. Investing creates wealth over the very long-term for investors and is not the same as gambling’s zero-sum game.

Limits to Investing Losses

Investors can often limit their losses and get out of a trade if they start to lose money. Stock investors can establish a trading order called a stop loss with their broker or online brokerage firm to limit their losses. I often immediately place a stop loss order after purchasing shares 10% lower than my purchase price on the off chance that the company is hit by a selling frenzy before I can get in to sell my shares.

Sometimes, I’ll place a similar limit order when I’m swing trading to sell shares at my target upside price as well to lock in my target profit margin. Many times I’m looking for a 10% raise in a stock when I’m swing trading, and I routinely place limit orders as soon as I buy a stock.

With a stop loss order placed, I will only lose 10% if a stock drops in value below what I purchased it for. This helps me sell the stock to someone else and retain 90% of my capital, limited my downside risk.

Time Horizons for Trading and Gambling

Time horizons are another difference between investing and gambling. They are different than gambling even if you’re day trading, swing trading, or simply buying and holding your investments. Most gambling is a time-based event that has a set end time or date where you find out whether you’ve won or lost your bet. Investing can continue indefinitely in some cases.

Many companies pay dividends to investors and reward them for purchased shares for years. You can lose money on paper as your investment value declines, but dividend paying stocks will continue to pay you typically each quarter to wait for a rebound. With gambling, you either have to win or lose the money that you bet. There is no middle ground.

Limited Information

Unlike investing, there is only a limited amount of information while you are gambling. You may be able to pick up a few signals from the table or hear a few grumbles from your fellow blackjack players at a casino on whether or not the table is hot or cold. But, that’s about all of the information that you’ll get.

Investing is completely different. There is a plethora of information about the companies you invest in through online forums, stock analysts’ reports, conference calls, company filings, and the like. While gamblers are almost blind to any inside information that can help them get an edge on their competition.

Gambling and investing have a lot of similarities. But, they are also very different. Investing in the stock market is not gambling.

Equating the stock market to gambling is a myth that is simply not true. Both involve risk and each looks to maximize profit, but investing is not gambling. And, gambling is not investing. Each plays a unique role in our society, but investors should not confuse where the similarities end and make each one unique from the other.

What do you think? Is the stock market gambling? Do you consider trading in the stock market to be a form of gambling? Why? I’d love to hear your thoughts in the comment section below.